Gratuity is an important component of employee compensation, serving as a token of appreciation for long-term service. Understanding how gratuity is calculated is crucial for both employers and employees to ensure fair compensation and financial planning. This article will delve into the intricacies of gratuity calculation, providing a clear and comprehensive guide to help you navigate this essential aspect of employment benefits.

Understanding Gratuity

Gratuity is a monetary benefit provided by employers to employees as a gesture of gratitude for their service to the organization. It is typically paid when an employee leaves the company after completing a minimum period of continuous service, usually five years or more.

Legal Framework

In India, gratuity is governed by the Payment of Gratuity Act, 1972. This act applies to establishments with 10 or more employees. However, even organizations not covered under this act often provide gratuity benefits to their employees.

How Is Gratuity Calculated?

The calculation of gratuity depends on various factors, including whether the employee is covered under the Payment of Gratuity Act, 1972, or not. Let’s explore both scenarios:

For Employees Covered Under the Act

For employees covered under the Payment of Gratuity Act, 1972, the gratuity calculation formula is:

$$ \text{Gratuity} = \frac{15 \times \text{Last Drawn Salary} \times \text{Number of Years of Service}}{26} $$

Where:

– Last Drawn Salary includes Basic Salary and Dearness Allowance

– 15 represents 15 days of salary

– 26 represents the number of working days in a month

For Employees Not Covered Under the Act

For employees working in organizations not covered under the Payment of Gratuity Act, the formula slightly differs:

$$ \text{Gratuity} = \frac{15 \times \text{Last Drawn Salary} \times \text{Number of Years of Service}}{30} $$

The main difference here is the use of 30 days instead of 26 working days.

Post-NDA Army Posting: Rank, Salary, and Key Details You Need to Know

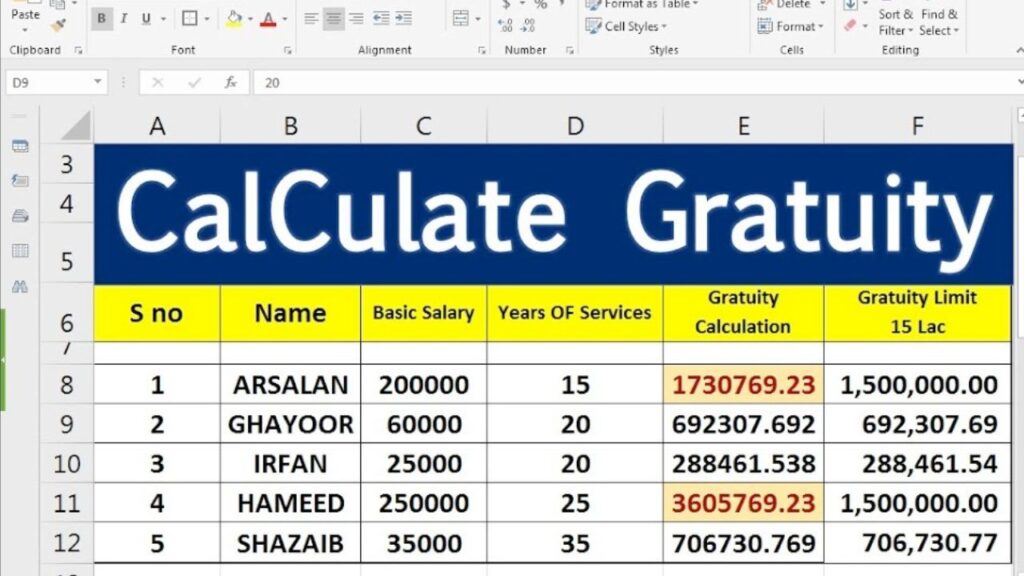

Gratuity Calculation Examples

Let’s look at some examples to better understand how gratuity is calculated:

Example 1: Employee Covered Under the Act

Mr. Skanda’s last drawn basic pay is ₹45,000 per month, and he has worked for XYZ Ltd for 24 years and 10 months.

Gratuity Amount = (15 × 45,000 × 25) / 26 = ₹6,49,038

Example 2: Employee Not Covered Under the Act

Mr. Krishna works for a firm not covered under the Payment of Gratuity Act. His last drawn basic pay is ₹30,000 per month, and he has worked for the organization for 23 years and 5 months.

Gratuity Amount = (15 × 30,000 × 24) / 30 = ₹3,45,000

Exciting OTT Releases in 2025: ‘Paatal Lok Season 2’, ‘The Family Man 3’, and More Must-Watch

Factors Affecting Gratuity Calculation

Several factors can influence the gratuity calculation:

1. **Last Drawn Salary**: This typically includes Basic Salary and Dearness Allowance. Some organizations may also include other components like commission on sales.

2. **Years of Service**: The number of completed years of service is crucial. Any period exceeding six months is rounded up to the next full year.

3. **Organization Type**: Whether the organization is covered under the Payment of Gratuity Act or not affects the calculation formula.

4. **Maximum Limit**: There’s a cap on the maximum gratuity amount that can be paid tax-free, which is currently set at ₹20 lakhs.

Using a Gratuity Calculator

To simplify the process, many online tools and calculators are available. These gratuity calculators typically require you to input:

1. Last drawn salary (Basic + DA)

2. Number of years of service

3. Sometimes, commission on sales (if applicable)

The calculator then applies the appropriate formula to provide an estimated gratuity amount[9].

Benefits of Understanding Gratuity Calculation

1. **Financial Planning**: Knowing how gratuity is calculated helps employees plan their finances better, especially when considering retirement or job changes.

2. **Transparency**: It ensures transparency between employers and employees regarding compensation.

3. **Compliance**: For employers, understanding gratuity calculation is crucial for legal compliance and accurate financial provisioning.

4. **Employee Satisfaction**: Clear communication about gratuity calculation can enhance employee satisfaction and trust in the organization.

Common Misconceptions About Gratuity

1. **Gratuity is Always Tax-Free**: While gratuity is tax-free up to a certain limit (currently ₹20 lakhs), any amount exceeding this is taxable.

2. **All Employees are Eligible**: Gratuity is typically paid only after completing five years of continuous service, with some exceptions like death or disability.

3. **Gratuity is Calculated on Total Salary**: It’s usually calculated based on Basic Salary and Dearness Allowance, not on the total Cost to Company (CTC).

Understanding how gratuity is calculated is essential for both employers and employees. It involves considering factors like last drawn salary, years of service, and the applicable legal framework. By using the correct formula and staying informed about the latest regulations, you can ensure accurate gratuity calculations and better financial planning.

Remember, while the formulas and examples provided here offer a general guide, specific cases may vary. It’s always advisable to consult with HR professionals or financial advisors for personalized advice on gratuity calculations and related matters.